This study provides a holistic and systematic review of the literature on the utilization of artificial intelligence (AI) in the banking sector since 2005. In this study, the authors examined 44 articles through a systematic literature review approach and conducted a thematic and content analysis on them. This review identifies research themes demonstrating the utilization of AI in banking, develops and classifies sub-themes of past research, and uses thematic findings coupled with prior research to propose an AI banking service framework that bridges the gap between academic research and industry knowledge. The findings demonstrate how the literature on AI and banking extends to three key areas of research: Strategy, Process, and Customer. These findings may benefit marketers and decision-makers in the banking sector to formulate strategic decisions regarding the utilization and optimization of value from AI technologies in the banking sector. This study also provides opportunities for future research.

Avoid common mistakes on your manuscript.

Digital innovations in the modern banking landscape are no longer discretionary for financial institutions; instead, they are becoming necessary for financial institutions to cope with an increasingly competitive market and changing customer expectations (De Oliveira Santini, 2018; Eren, 2021; Hua et al., 2019; Rajaobelina and Ricard, 2021; Valsamidis et al., 2020; Yang, 2009). In the era of modern banking, many new digital technologies have been driven by artificial intelligence (AI) as the key engine (Dobrescu and Dobrescu, 2018), leading to innovative disruptions of banking channels (e.g., automated teller machines, online banking, mobile banking), services (e.g., imaging of checks, voice recognition, chatbots), and solutions (e.g., AI investment advisors and AI credit selectors).

The application of AI in banking is across the board, with uses in the front office (voice assistants and biometrics), middle office (anti-fraud risk monitoring and complex legal and compliance workflows), and back office (credit underwriting with smart contracts infrastructure). Banks are expected to save $447 billion by 2023, by employing AI applications. Almost 80% of the banks in the USA are cognizant of the potential benefits offered by AI (Digalaki, 2022). Indeed, the emergence of AI has generated a wealth of opportunities and challenges (Malali and Gopalakrishnan, 2020). In the banking context, the use of AI has led to more seamless sales and has guided the development of effective customer relationship management systems (Tarafdar et al., 2019). While the focus in the past was on the automation of credit scoring, analyses, and the grants process (Mehrotra, 2019), capabilities evolved to support internal systems and processes as well (Caron, 2019).

The term AI was first used in 1956 by John McCarthy (McCarthy et al., 1956); it refers to systems that act and think like humans in a rational way (Kok et al., 2009). In the aftermath of the dot com bubble in 2000, the field of AI shifted toward Web 2.0. era in 2005, and the growth of data and availability of information encouraged more research in AI and its potential (Larson, 2021). More recently, technological advancements have opened the doors for AI to facilitate enterprise cognitive computing, which involves embedding algorithms into applications to support organizational processes (Tarafdar et al., 2019). This includes improving the speed of information analysis, obtaining more accurate and reliable data outputs, and allowing employees to perform high-level tasks. In recent years, AI-based technologies have been shown to be effective and practical. However, many corporate executives still lack knowledge regarding the strategic utilization of AI in their organizations. For instance, Ransbotham et al. (2017) found that 85% of business executives viewed AI as a key tool for providing businesses with a sustainable competitive advantage; however, only 39% had a strategic plan for the use of AI, due to the lack of knowledge regarding implementation of AI for their organizations.

Here, we systematically analyze the past and current state of AI and banking literature to understand how it has been utilized within the banking sector historically, propose a service framework, and provide clear future research opportunities. In the past, a limited number of systematic literature reviews have studied AI within the management discipline (e.g., Bavaresco et al., 2020; Borges et al., 2020; Loureiro et al., 2020; Verma et al., 2021). However, the current literature lacks either research scope and depth, and/or industry focus. In response, we seek to differentiate our study from prior reviews by providing a specific focus on the banking sector and a more comprehensive analysis involving multiple modes of analysis.

In light of this, we aim to address the following research questions:

Adhering to the best practices for conducting a Systematic Literature Review (SLR) (see Khan et al., 2003; Tranfield et al, 2003; Xiao and Watson, 2019), we began by selecting the appropriate database and identifying keywords, based on an in-depth review of the literature. Research papers were extracted from Web of Science (WoS) and Scopus. These databases were selected to complement one another and provide access to scholarly articles (Mongeon and Paul-Hus, 2016); this was also the first step in ensuring the inclusion of high-quality articles (Harzing and Alakangas, 2016). The following query was used to search the title, abstract, and keywords: “Artificial intelligence OR machine learning OR deep learning OR neural networks OR Intelligent systems AND Bank AND consumer OR customer OR user.” The keywords were selected, based on prior literature review, with the goal of covering various business functions, especially focusing on the banking sector (Loureiro et al., 2020; Verma et al., 2021; Borges et al., 2020; Bavaresco et al., 2020). The initial search criteria yielded 11,684 papers. These papers were then filtered by “English,” “article only” publications, and using the subject area filter of “Management, Business Finance, accounting and Business,” which resulted in 626 papers.

In this study, we used the preferred reporting method for systematic reviews and meta-analyses (PRISMA) to ensure that we follow the systematic approach and track the flow of data across different stages of the SLR (Moher et al., 2009). After extracting the articles, each of the 626 papers was given a distinctive ID number to help differentiate the papers; the ID number was maintained throughout the analysis process. The data were then organized using the following columns: “ID number,” “database source,” “Author,” “title,” “Abstract,” “keywords,” “Year,” Australian Business Deans Council (ABDC) Journals, “and keyword validation columns.”

The exclusion of papers was done systematically in the following manner: a) All duplicate papers in the database were eliminated (105 duplicates); b) as a second quality check, papers not published in ABDC journals (163 papers) were omitted to ensure a quality standard for inclusion in the review,Query a practice consistent with other recent SLRs (Goyal and Kumar, 2021; Nusair et al., 2019; Pahlevan-Sharif et al., 2019); c) in order to ensure the relevance of articles included, and following our research objectives, we excluded non-consumer-related papers, searching for consumers (consumer, customer, user) in the title, abstract, and keywords; this resulted in the removal of 314 papers; d) for the remaining 48 papers, a relevance check was manually conducted to determine whether the papers were indeed related to AI and banking. Papers that specifically focused on the technical computational process of AI were removed (4 papers). This process resulted in the selection of 44 articles for subsequent analyses.

A thematic analysis classifies the topics and subtopics being researched. It is a method for identifying, analyzing, and reporting patterns within data (Boyatzis, 1998). We followed Chatha and Butt (2015) to classify the articles into themes and sub-themes using manual coding. Second, we employed the Leximancer software to supplement the manual classification process. The use of these two approaches provides additional validity and quality to the research findings.

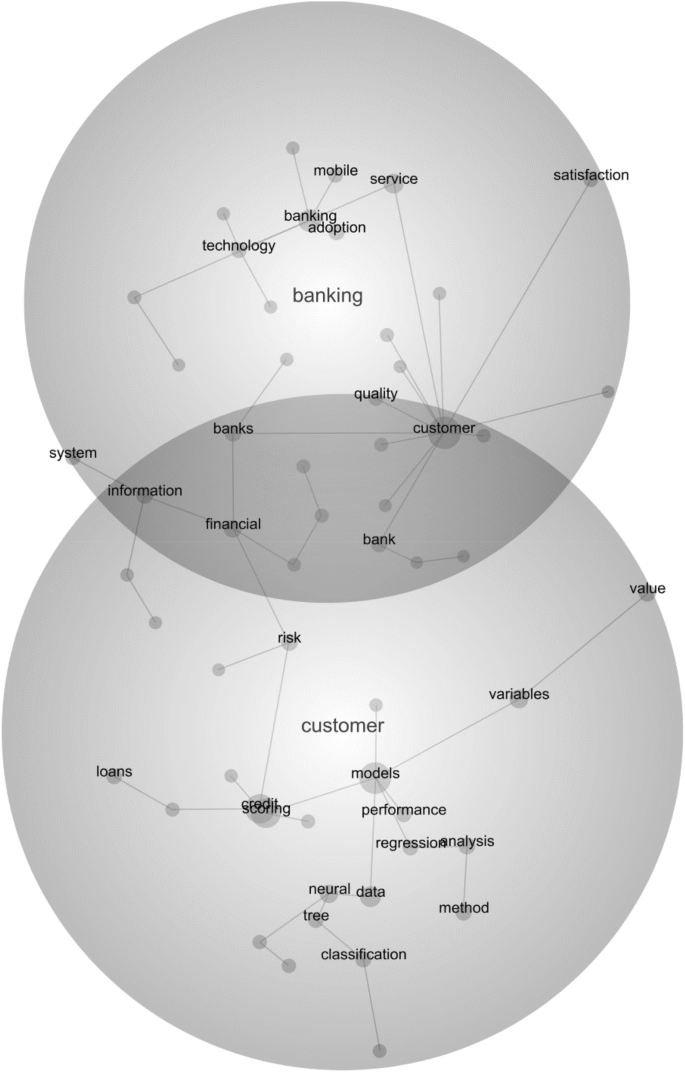

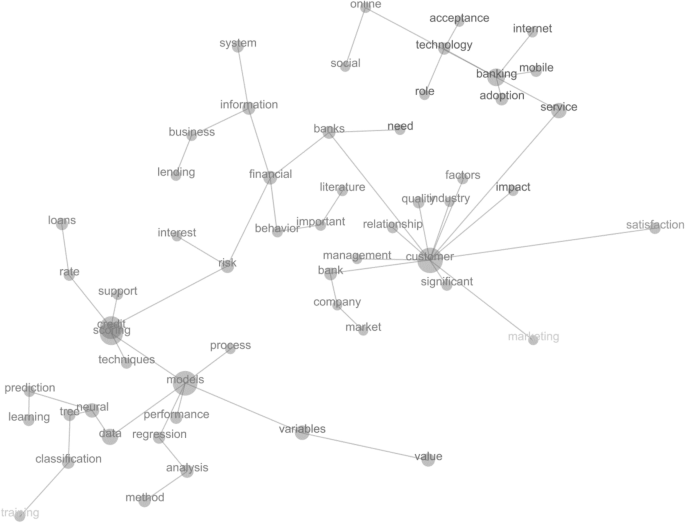

Leximancer is a text-mining software that provides conceptual and relational information by identifying concept occurrences and co-occurrences (Leximancer, 2019). After uploading all the 44 papers onto Leximancer, we added “English” to the stoplist, which removed words such as “or/and/like” that are not relevant to developing themes. We manually removed irrelevant filler words, such as “pp.,” “Figure,” and “re.” Finally, our results consisted of two maps: a) a conceptual map wherein central themes and concepts are identified, and b) a relational cloud map where a network of connections and relationships are drawn among concepts.

RQ 1: What are the themes and sub-themes that emerge from prior literature regarding the utilization of AI in the banking industry?

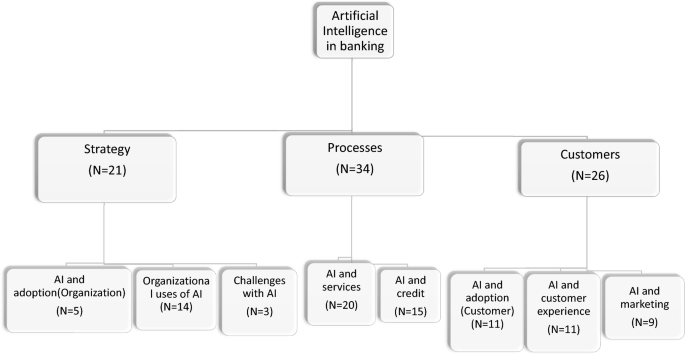

We began with a deductive approach to categorize articles into predetermined themes for the theme identification process. We then employed an inductive approach to identify the sub-themes and provide context for the primary themes (See Fig. 1). The procedure for determining the primary themes included, a) reviewing previous related systematic literature reviews (Bavaresco et al., 2020; Borges et al., 2020; Loureiro et al., 2020; Verma et al., 2021), b) identifying keywords and developing codes (themes) from selected papers; and c) reviewing titles, abstracts, and full papers, if needed, to identify appropriate allocation within these themes. Three primary themes were curated from the process: Strategy, Processes, and Customers (see Fig. 2).

In the Strategy theme (21 papers), early research shows the potential uses and adoption of AI from an organizational perspective (e.g., Akkoç, 2012; Olson et al., 2012; Smeureanu et al., 2013). Data mining (an essential part of AI) has been used to predict bankruptcy (Olson et al., 2012) and to optimize risk models (Akkoç, 2012). The increasing use of AI-driven tools to drive organizational effectiveness creates greater business efficiency opportunities for financial institutions, as compared to traditional modes of strategizing and risk model development. The sub-theme Organizational use of AI (14 papers) covers a range of current activities wherein banks use AI to drive organizational value. These organizational uses include the use of AI to drive business strategies and internal business activities. Medhi and Mondal (2016) highlighted the use of an AI-driven model to predict outsourcing success. Our findings indicate the effectiveness of AI tools in driving efficient organizational strategies; however, there remain several challenges in implementing AI technologies, including the human resources aspect and the organizational culture to allow for such efficiencies (Fountain et al., 2019). More recently, there has been a noticeable focus on discussing some of the challenges associated with AI implementation in banking institutions (e.g., Jakšič and Marinč, 2019; Mohapatra, 2020). The sub-theme Challenges with AI (three papers) covers a range of challenges that organizations face, including the integration of AI in their organizations. Mohapatra (2020) characterizes some of the key challenges related to human–machine interactions to allow for the sustainable implementation of AI in banking. While much of the current research has focused on technology, our findings indicate that one of the main areas of opportunity in the future is related to adoption and integration. The sub-theme AI and adoption in financial institutions (six papers) covered a range of topics regarding motivation, and barriers to the adoption of AI technology from an organizational standpoint. Fountain et al. (2019) conceptually highlighted some barriers to organizational adoption, including workers’ fear, company culture, and budget constraints. Overall, in the Strategy theme, organizational uses of AI seemed to be the most prominent, which highlights the consistent focus on technology development compared with technology implementation. However, the literature remains limited in terms of discussions related to the organizational challenges associated with AI implementation.

In the Processes theme (34 papers), after the dot com bubble and with the emergence of Web 2.0, research on AI in the banking sector started to emerge. This could have been triggered by the suggested use of AI to predict stock market movements and stock selection (Kim and Lee, 2004; Tseng, 2003). At this stage, the literature on AI in the banking sector was related to its use in credit and loan analysis (Baesens et al., 2005; Ince and Aktan, 2009; Kao et al., 2012; Khandani et al., 2010). In the early stages of AI implementation, it is essential to develop fast and reliable AI infrastructure (Larson, 2021). Baesens et al. (2005) utilized a neural network approach to better predict loan defaults and early repayments. Ince and Aktan (2009) used a data mining technique to analyze credit scores and found that the AI-driven data mining approach was more effective than traditional methods. Similarly, Khandani et al. (2010) found machine-learning-driven models to be effective in analyzing consumer credit risk. The sub-theme, AI and credit (15 papers), covers the use of AI technology, such as machine learning and data mining, to improve credit scoring, analysis, and granting processes. For instance, Alborzi and Khanbabaei (2016) examined the use of data mining neural network techniques to develop a customer credit scoring model. Post-2013, there has been a noticeable increase in investigating how AI improves processes that go beyond credit analysis. The sub-theme AI and services (20 papers) covers the uses of AI for process improvement and enhancement. These process-related uses of technology include institutional uses of technology to improve internal service processes. For example, Soltani et al. (2019) examined the use of machine learning to optimize appointment scheduling time, and reduce service time. Overall, regarding the process theme, our findings highlight the usefulness of AI in improving banking processes; however, there remains a gap in practical research regarding the applied integration of technology in the banking system. In addition, while there is an abundance of research on credit risk, the exploration of other financial products remains limited.

In the Customer theme (26 papers), we uncovered the increasing use of AI as a methodological tool to better understand customer adoption of digital banking services. The sub-theme AI and Customer adoption (11 papers) covers the use of AI as a methodological tool to investigate customers’ adoption of digital banking technologies, including both barriers and motivational factors. For example, Arif et al. (2020) used a neural network approach to investigate barriers to internet-banking adoption by customers. Belanche et al. (2019) investigate factors related to AI-driven technology adoption in the banking sector. Payne et al. (2018) examine the drivers of the usage of AI-enabled mobile banking services. In addition, bank marketers have found an opportunity to use AI to better segment, target, and position their banking products and services. The sub-theme, AI and marketing (nine papers), covers the use of AI for different marketing activities, including customer segmentation, development of marketing models, and delivery of more effective marketing campaigns. For example, Smeureanu et al. (2013) proposed a machine learning technique to segment banking customers. Schwartz et al. (2017) utilized an AI-based method to examine the resource allocation in targeted advertisements. In recent years, there has been a noticeable trend in investigating how AI shapes customer experience (Soltani et al., 2019; Trivedi, 2019). The sub-theme of AI and customer experience (Papers 11) covers the use of AI to enhance banking experience and services for customers. For example, Trivedi (2019) investigated the use of chatbots in banking and their impact on customer experience.

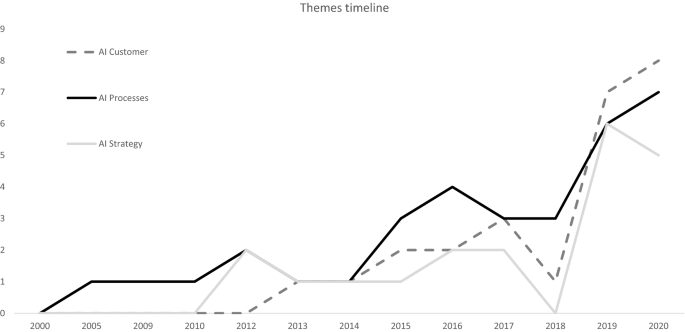

Table 1 highlights the number of papers included in the themes and sub-themes. Overall, the papers related to Processes (77%) were the most frequently occurring, followed by Customer (59%) and Strategy-based (48%) papers. From 2013 onward, there was an increase in the inter-relation between all three areas of Strategy, Processes, and Customers. Since 2016, there has been a surge in research linking the themes of Processes and Customers. More recently, since 2017, papers combining Customers with Strategy have become more frequent.

Not surprisingly, the second most prominent concept is “banking,” which is expected as it is the sector that we are examining. The concept “banking” appeared 1,033 times across all the papers. In the “banking” concept, some of the key concept associations include mobile (248 co-occurrences and 88% word association), internet (152 co-occurrences and 82% word association), adoption (220 co-occurrences and 50% word association), and acceptance (71 co-occurrences and 42% word association). This implies the importance of utilizing AI in mobile- and internet-banking research, along with inquiries related to the adoption and acceptance of AI for such uses. Belanche et al. (2019) proposed a research framework to provide a deeper understanding of the factors driving AI-driven technology adoption in the banking sector. Payne et al. (2018) examined digital natives' comfort and attitudes toward AI-enabled mobile banking activities and found that the need for services, attitude toward AI, relative advantage, and trust had a significant positive association with the usage of AI-enabled mobile banking services.

Figure 4 highlights the concept associations and draws connections between concepts. The identification and classification of themes and sub-themes using the deductive method in thematic analysis, and the automated approach using Leximancer, provide a reliable and detailed overview of the prior literature.

RQ 2: How does AI impact the banking customer’s journey?

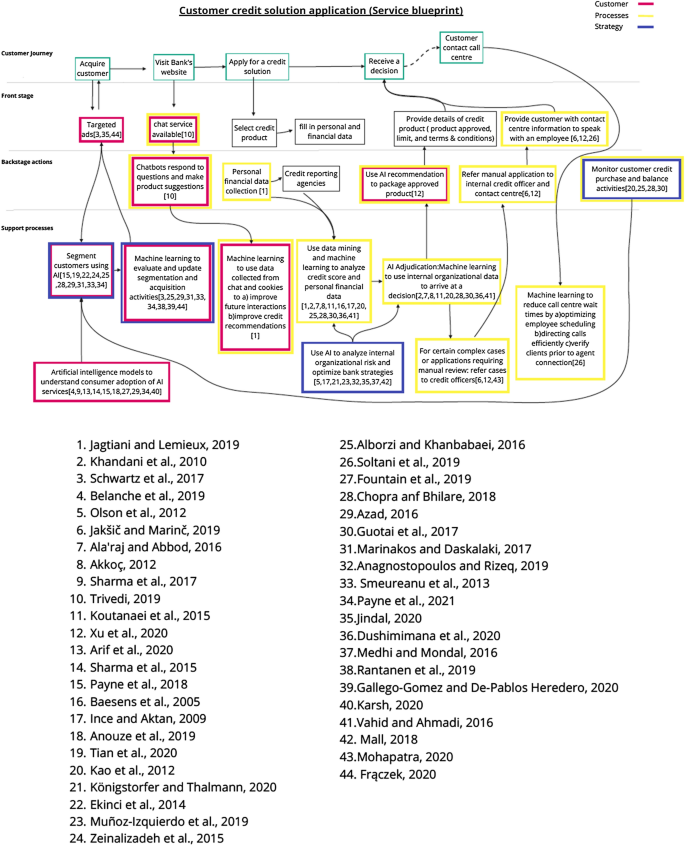

A service blueprint is a method that conceptualizes the customer journey while providing a framework for the front/back-end and support processes (Shostack, 1982). For a service blueprint to be effective, the core focus should be on the customer, and steps should be developed based on data and expertise (Bitner et al., 2008). As previously discussed, one of the key research areas, AI and banking, relates to credit applications and granting decisions; these are processes that directly impact customer accessibility and acquisition. Here, we develop and propose a Customer Credit Solution Application-Service Blueprint (CCSA) based on our earlier analyses.

Not only was the proposed design developed but the future research direction was also extracted from the articles included in this study. We also validated the framework through direct consultation with banking industry professionals. The CCSA model allows marketers, researchers, and banking professionals to gain a deeper understanding of the customer journey, understand the role of AI, provide an overview of future research directions, and highlight the potential for future growth in this field. As seen in Fig. 5, we divided the service blueprint into four distinct segments: customer journey, front-stage, back-stage, and support processes. The customer journey is the first step in building a customer-centric blueprint, wherein we highlight the steps taken by customers to apply for a credit solution. The front-stage refers to how the customer interacts with a banking touchpoint (e.g., chatbots). Back-stage actions provide support to customer-facing front-stage actions. Support processes aid in internal organizational interactions and back-stage actions. This section lays out the steps for applying for credit solutions online and showcases the integration and use of AI in the process, with examples from the literature.

We begin from the initial step of customer acquisition, and proceed to credit decision, and post-decision (Broby, 2021). In the acquisition step, customers are targeted with the goal of landing them on the website and converting them to active customers. The front-stage includes targeted ads, where customers are exposed to ads that are tailored for them. For instance, Schwartz et al. (2017) utilized a multi-armed bandit approach for a large retail bank to improve customer acquisition, and proposed a method that allows bank marketers to maintain the balance between learning from advertisement data and optimizing advertisement investment. At this stage, the support processes focus on integrating AI as a methodological tool to better understand customers' banking adoption behaviors, in combination with utilizing machine learning to evaluate and update segmentation activities. The building block at this stage, is understanding the factors of online adoption. Sharma et al. (2017) used the neural network approach to investigate the factors influencing mobile banking adoption. Payne et al. (2018) examined digital natives' comfort and attitudes toward AI-enabled mobile banking activities. Markinos and Daskalaki (2017) used machine learning to classify bank customers based on their behavior toward advertisements.

At this stage, banking institutions aim to convert website traffic to credit solution applicants. The integration of robo-advisors will help customers select a credit solution that they can best qualify for, and which meets their banking needs. The availability of a robo-advisor can enhance the service offering, as it can help customers with the appropriate solution after gathering basic personal financial data and validating it instantly with credit reporting agencies. Trivedi (2019) found that information, system, and service quality are key to ensuring a seamless customer experience with the chatbot, with personalization moderating the constructs. Robo-advisors have task-oriented features (e.g., checking bank accounts) coupled with problem-solving features (e.g., processing credit applications). Following this, the data collected will be consistently examined through the use of machine learning to improve the offering and enhance customer experience. Jagtiani and Lemieux (2019) used machine learning to optimize data collected through different channels, which helps arrive at appropriate and inclusive credit recommendations. It is important to note that while the proposed process provides immense value to customers and banking institutions, many customers are hesitant to share their information; thus, trust in the banking institution is key to enhancing customer experience.

After the data have been collected through the online channel, data mining and machine learning will aid in the analysis and provide optimal credit decisions. At this stage, the customer receives a credit decision through the robo-advisor. The traditional approaches for credit decisions usually take up to two weeks, as the application goes to the advisory network, then to the underwriting stage, and finally back to the customer. However, with the integration of AI, the customer can save time and be better informed by receiving an instant credit decision, allowing an increased sense of empowerment and control. The process of arriving at such decisions should provide a balance between managing organizational risk, maximizing profit, and increasing financial inclusion. For instance, Khandani et al. (2010) utilized machine learning techniques to build a model predicting customers' credit risk. Koutanaei et al. (2015) proposed a data mining model to provide more confidence in credit scoring systems. From an organizational risk standpoint, Mall (2018) used a neural network approach to examine the behavior of defaulting customers, so as to minimize credit risk, and increase profitability for credit-providing institutions.

At this stage, we outline the relationship between humans and AI. As Xu et al. (2020) found that customers prefer humans for high-complexity tasks, the integration of human employees for cases that require manual review is vital, as AI can make errors or misevaluate one of the C's of credit (Baiden, 2011). While AI provides a wealth of benefits for customers and organizations, we refer to Jakšič and Marinč's (2019) discussion that relationship banking still plays a key role in providing a competitive advantage for financial institutions. The integration of AI at this stage can be achieved by optimizing banking channels. For instance, banking institutions can optimize appointment scheduling time and reduce service time through the use of machine learning, as proposed by Soltani et al. (2019).

Researchers have recognized the viable use of AI to provide enhanced customer service. As discussed in the CCSA service advice, facilities, such as robo-advisors, can aid in product selection, application for banking solutions, and time-saving in low-complexity tasks. As AI has been shown to be an effective tool for automating banking processes, improving customer satisfaction, and increasing profitability, the field has further evolved to examine issues pertaining to strategic insights. Recent research has been focused on investigating the use of AI to drive business strategies. For instance, researchers have examined the use of AI to simplify internal audit reports and evaluate strategic initiatives (Jindal, 2020; Muñoz-Izquierdo et al., 2019). The latest research also highlights the challenges associated with AI, whether from the perspective of implementation, culture, or organizational resistance (Fountain et al., 2019). Moreover, one of the key challenges uncovered in the CCSA is privacy and security concerns of customers in sharing their information. As AI technologies continue to grow in the banking sector, the privacy-personalization paradox has become a key research area that needs to be examined.

In addition, the COVID-19 pandemic has brought on a plethora of challenges in the implementation of AI in the banking sector. Although banks' interest in AI technologies remains high, the reduction in revenue has resulted in a decrease in short-term investment in AI technologies (Anderson et al., 2021). Wu and Olson (2020) highlight the need for banking institutions to continue investing in AI technologies to reduce future risks and enhance the integration between online and offline channels. From a customer perspective, COVID-19 has led to an uptick in the adoption of AI-driven services such as chatbots, E-KYC (Know your client), and robo-advisors (Agarwal et al., 2022).

RQ 3: What are the current research deficits and the future directions of research in this field?

Tables 2, 3, and 4 provide a complete list of recommendations for future research. These recommendations were developed by reviewing all the future research directions included in the 44 papers. We followed Watkins' (2017) rigorous and accelerated data reduction (RADaR) technique, which allows for an effective and systematic way to analyze and synthesize calls for future research (Watkins, 2017).

Table 2 Detailed future research directions—Theme: Strategy Table 3 Detailed future research recommendations—Theme: Processes Table 4 Detailed future research recommendations—Theme: CustomerRegarding strategy, as AI continues to grow in the banking industry, financial institutions need to examine how internal stakeholders perceive the value of embracing AI, the role of leadership, and multiple other variables that impact the organizational adoption of AI. Therefore, we recommend that future research investigate the different factors (e.g., leadership role) that impact the organizational adoption of AI technologies. In addition, as more organizations use and accept AI, internal challenges emerge (Jöhnk et al., 2021). Thus, we recommend examining the different organizational challenges (e.g., organizational culture) associated with AI adoption.

Regarding processes, AI and credit is one of the areas that has been extensively explored since 2005 (Bhatore et al., 2020). We recommend expanding beyond the currently proposed models and challenging the underlying assumptions by exploring new aspects of risks presented with the introduction of AI technologies. In addition, we recommend the use of more practical case studies to validate new and existing models. Additionally, the growth of AI has evoked further exploration of how internal processes can be improved (Akerkar, 2019). For instance, we suggest investigating AI-driven models with other financial products/solutions (e.g., investments, deposit accounts, etc.).

Regarding customers, the key theories mentioned in the research papers included in the study are the Technology Acceptance Model (TAM) and diffusion of innovation theories (Anouze and Alamro, 2019; Azad, 2016; Belanche et al., 2019; Payne et al., 2018; Sharma et al., 2015, 2017). However, as customers continue to become accustomed to AI, it may be imperative to develop theories that go beyond its acceptance and adoption. Thus, we recommend investigating different variables (e.g., social influence and user trends) and methods (e.g., cross-cultural studies) that impact customers' relationship with AI. The gradual shift toward its customer-centric utilization has prompted the exploration of new dimensions of AI that influence customer experience. Going forward, it is important to understand the impact of AI on customers and how it can be used to improve customer experience.

This study had several limitations. During our inclusion/exclusion criteria, it is plausible that some AI/banking papers may have been missed because of the specific keywords used to curate our dataset. In addition, articles may have been missed due to the time when the data were collected, such as Manrai and Gupta (2022), who examined investors' perceptions of robo-advisors. Second, regarding theme identification, there may be a potential bias toward selecting themes, which may lead to misclassification. In addition, we acknowledge that the papers were extracted only from the WoS and Scopus databases, which may limit our access to certain peer-reviewed outlets.

This research provides insights for practitioners and marketers in the North American banking sector. To assist in the implementation of AI-based decision-making, we encourage banking professionals to consider further refining their use of AI in the credit scoring, analysis, and granting processes to minimize risk, reduce costs, and improve customer experience. However, in doing so, we recommend using AI not only to improve internal processes but also as a tool (e.g., chatbots) to improve customer service for low-complexity tasks, thereby directing employees' efforts to other business-impacting activities. Moreover, we recommend using AI as a marketing segmentation tool to target customers for optimal solutions.

This study systematically reviewed the literature (44 papers) on AI and banking from 2005 to 2020. We believe that our findings may benefit industry professionals and decision-makers in formulating strategic decisions regarding the different uses of AI in the banking sector, and optimizing the value derived from AI technologies. We advance the field by providing a more comprehensive outlook specific to the area of AI and banking, reflecting the history and future opportunities for AI in shaping business strategies, improving logistics processes, and enhancing customer value.